Saving money can feel like a daunting task, but it is the single most important habit for building a secure future. For instance, whether you’re planning for a vacation, a down payment on a home, or a comfortable retirement, the secret to success isn’t about how much you earn. Instead, it’s about how much you save. The key is to adopt a strategy that fits your current life stage and financial goals leading to smarter savings.

Here’s a breakdown of effective saving techniques, with tips tailored to different age groups.

The Universal Rule: Pay Yourself First

Regardless of your age, the most powerful savings technique is to “pay yourself first.” This means, specifically, setting aside money for savings as soon as you get paid, and therefore, before you spend a single dollar on bills or wants. By automating a portion of your paycheck to go directly into a savings account, you eliminate the temptation to spend it. This makes saving a non-negotiable part of your budget, not an afterthought.

Young Adults Savings (18-25): Building the Foundation

This is the most crucial time to start saving, thanks to the power of compound interest. Even small amounts can grow into a significant nest egg over decades.

- Set Clear Goals: Your priorities should be building an emergency fund, which is 3-6 months of living expenses. Additionally, you should also focus on paying off any high-interest debt, such as credit card balances.

- Start Your Retirement Fund: If your employer offers a retirement plan (like a 401(k) or similar plan), contribute at least enough to get the full company match. It’s essentially free money and a powerful way to kickstart your savings.

- Create a Budget: Track your spending for a month to see where your money is going. Use the 50/30/20 rule as a guide: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

- Lifestyle Control: As you start earning more, avoid “lifestyle creep.” Therefore, instead of spending every raise you get, you should try to increase your savings rate. This way, your savings will grow much faster over time.

Mid-Career Professionals Savings (26-45): Juggling Multiple Goals

In this phase, you’re likely balancing multiple financial priorities, from saving for a family to buying a home. The challenge is to save for big, long-term goals without sacrificing your lifestyle.

- Increase Your Contributions: With your income likely increasing, this is the time to raise your retirement savings contributions. Aim to get closer to the recommended 15% of your income (including any employer match).

- Save for Big Purchases: Create separate savings accounts for specific goals like a down payment on a house, a new car, or your children’s college education. Naming the accounts (e.g., “New House Fund”) can keep you motivated.

- Invest Your Money: As your savings grow, consider moving beyond a basic savings account. Explore investment options like index funds or ETFs to help your money grow faster than inflation.

- Pay Down Debt: Focus on eliminating consumer debt and consider paying extra on your mortgage to save thousands in interest over the life of the loan.

Pre-Retirement Savings (46-60+): The Final Push

As you near the end of your working years, your focus shifts to maximizing your savings and creating a clear retirement plan.

- Maximize “Catch-Up” Contributions: If you’re 50 or older, take advantage of “catch-up” contributions for your retirement accounts, which allow you to save more than the standard limit.

- Assess Your Retirement Needs: Use a retirement calculator to determine if you’re on track to meet your goals. This is a crucial time to get a clear picture of how much you’ll need to live comfortably.

- Evaluate Your Portfolio: Your investment strategy should become more conservative to protect your nest egg from market volatility as you get closer to retirement.

- Plan for Healthcare: Research and plan for future healthcare costs, which can be one of the biggest expenses in retirement. A Health Savings Account (HSA) can be an excellent tool for this if you are eligible.

- Clear Your Debts: Prioritize paying off your mortgage and any other significant debts before you stop working. Entering retirement debt-free provides immense financial peace of mind.

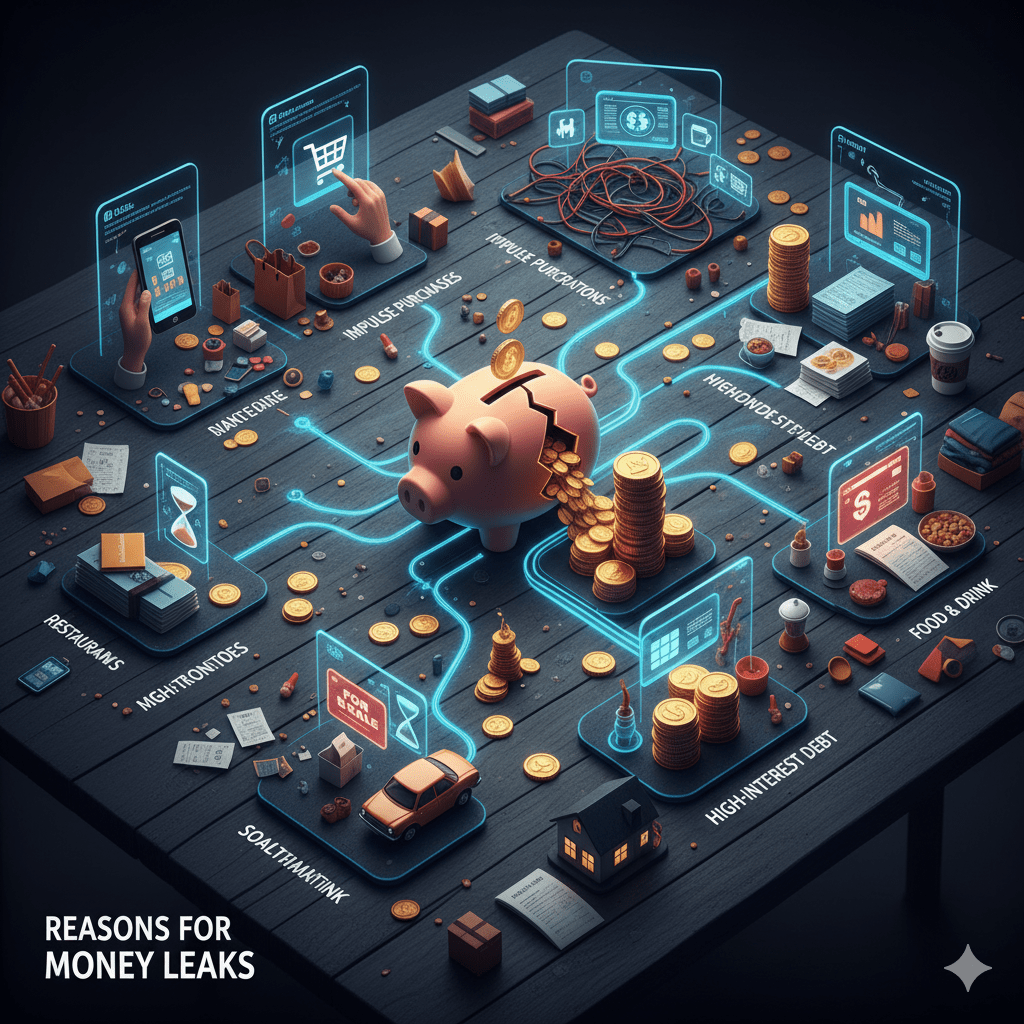

Common Money Mistakes & Reasons for Money Leaks

While budgeting can feel restrictive, it’s the lack of a clear plan that often causes money to slip away unnoticed.

Common Mistakes

1. Not Having a Budget is the most fundamental mistake. Without a budget, you have no roadmap for your money. You don’t know how much you’re spending, saving, or where you’re overspending. This “flying blind” approach makes it impossible to build real wealth and leaves you vulnerable to financial surprises.

2. Living Beyond Your Means This is the habit of spending more than you earn. It’s often fueled by a desire to keep up with friends, social media influencers, or a belief that you “deserve” a certain lifestyle. This leads to a constant cycle of debt, with high-interest credit card balances being the most common symptom.

3. Failing to Build an Emergency Fund An emergency fund is your safety net. Without one, any unexpected expense—like a car repair, medical bill, or job loss—can force you to take on high-interest debt, instantly draining your savings and putting you in a difficult financial position.

4. Impulse Purchases These are the small, unplanned purchases that seem harmless on their own but add up to a significant amount over time. For instance, that daily coffee, a last-minute online order, or an unplanned dinner out can quickly drain your discretionary spending and derail your savings goals.

5. Overlooking Subscriptions In the age of streaming services and online memberships, it’s easy to sign up for something and then forget about it. These recurring charges—for apps, streaming platforms, gym memberships, and more—are a silent leak in your budget.

6. Ignoring High-Interest Debt Many people only pay the minimum on their credit cards, student loans, or personal loans. This can trap you in a cycle where you’re primarily paying interest, and the principal balance barely goes down. High-interest debt is a major obstacle to financial freedom.

Where Money Leaks Most: Common Spending Categories

While money can leak from anywhere, certain categories are notorious for causing the most financial trouble.

1. Food & Drink This includes both groceries and dining out. People often spend far more on restaurants, take-out, and coffee than they realize. By tracking every dollar spent on food, you can identify a huge opportunity for savings.

2. Housing Housing is often a person’s largest expense. Overspending on rent or a mortgage can strain your budget, leaving little room for savings. For homeowners, unexpected maintenance costs and repairs can also become a major financial drain.

3. Transportation The costs of owning a car gas, insurance, maintenance, and car payments add up quickly. Buying a new, depreciating vehicle with a long-term loan is a common mistake that can cost you thousands in interest and lost value.

4. Entertainment & Subscriptions This category is a major source of “leaks.” From multiple streaming services to gym memberships you don’t use and expensive concert tickets, these expenses are often a “want” rather than a “need” and are one of the first places to look for cuts.

5. Personal Care & Shopping This category includes everything from clothing and haircuts to hobbies and online shopping. Careless or emotional spending in these areas can quickly lead to an empty bank account and debt.

No matter where you are in life, the best time to start saving is always now. By setting clear goals and consistently practicing good habits, you can build the financial security you need to live the life you want.

Disclaimer:

This blog post is intended for informational purposes only and should not be considered professional financial advice. Everyone’s financial situation is unique. If you are struggling with debt, are unable to save, or feel overwhelmed by your finances, it is highly recommended that you seek guidance from a qualified financial advisor, a certified credit counselor, or a mental health professional specializing in financial stress. Taking this step is a positive and proactive way to get on a secure path to financial well-being.

Read more blogs at : Okjango.com