Your credit score is more than just a number; in fact, it’s a key that unlocks opportunities, from securing a mortgage to getting a favorable interest rate on a car loan. Furthermore, a good credit score can save you thousands of dollars over your lifetime, whereas a poor one can make borrowing difficult and expensive. Therefore, understanding and improving your credit score is crucial for financial well-being.

Therefore, what exactly is a credit score, and how can you improve it? Let’s break down the fundamentals and provide actionable steps to help you on your journey to financial health.

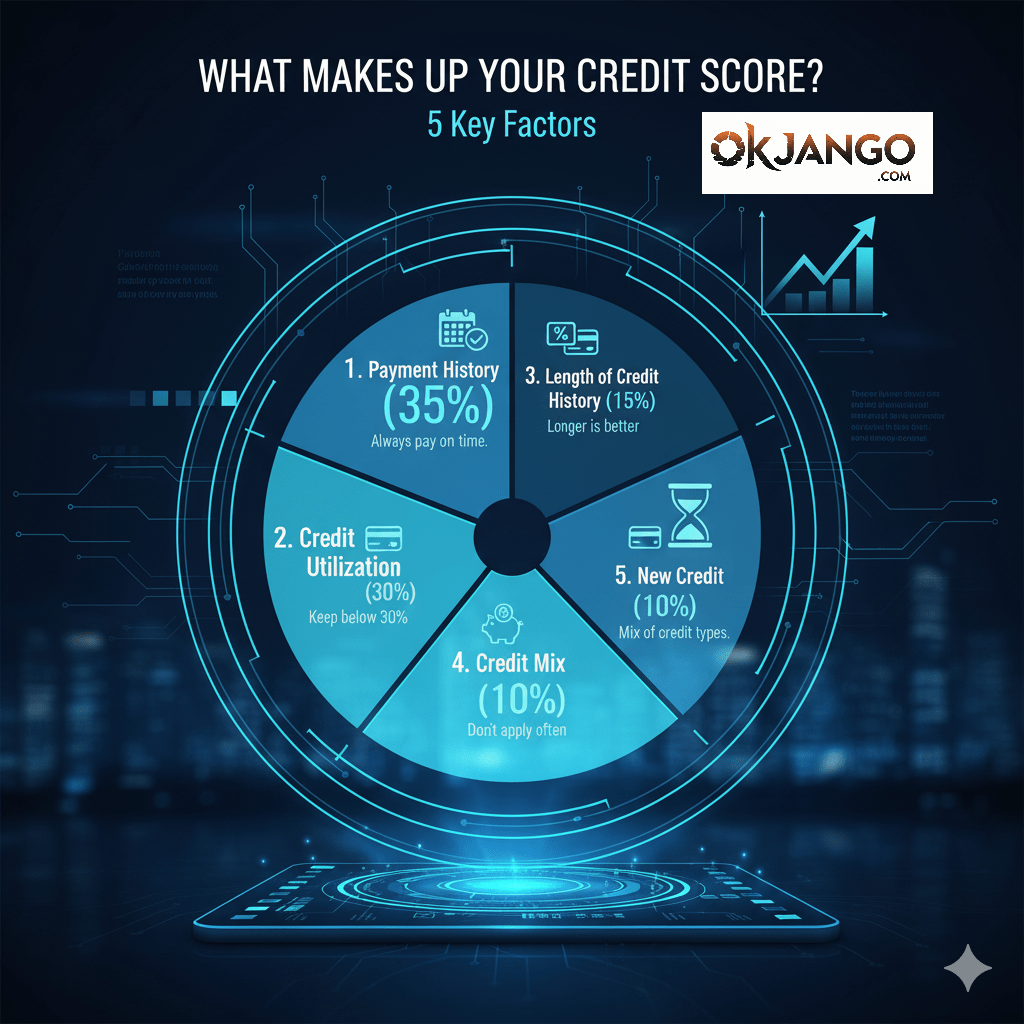

What Makes Up Your Credit Score?

For instance, while there are different scoring models (like FICO and VantageScore), they all generally look at a few core factors to determine your creditworthiness.

Consequently, understanding these factors is the first step toward improving your score.

Understanding these factors is the first step toward improving your score:

| Factor | Description & Why It Matters |

| Payment History (The Biggest Factor) | This is the most crucial element, accounting for a significant portion of your score. Paying bills on time, every time, is the single best way to build a positive credit history. Late or missed payments can have a serious, lasting negative impact. |

| Credit Utilization (The Second-Biggest Factor) | This is the percentage of your available credit you’re using. For example, a $300 balance on a $1,000 credit limit is 30% utilization. Experts recommend keeping this ratio below 30%—the lower, the better. |

| Length of Credit History | Lenders like to see a long history of responsible credit use. The longer your accounts have been open and in good standing, the better it is for your score. |

| Credit Mix | Having a variety of credit types, such as a credit card (revolving credit) and a car loan (installment credit), can positively impact your score. |

| New Credit | Applying for new credit results in a “hard inquiry” on your credit report. This can cause a small, temporary dip in your score, and too many applications in a short period can signal to lenders that you may be a high-risk borrower. |

5 Actionable Tips to Boost Your Credit Score

Although improving your credit score might seem daunting, it’s a goal you can, in fact, achieve with a few smart, consistent habits. Therefore, think of these steps as the foundation for a stronger financial future.

Think of these steps as the foundation for a stronger financial future.

| Actionable Tip | Why It Matters | How to Do It |

| Pay on Time, Every Time | This is the most crucial factor, accounting for a significant portion of your score. Late payments can cause a major, lasting drop. | Set up automatic payments. Make at least the minimum payment by the due date. |

| Lower Your Credit Utilization | Your credit utilization ratio (debt vs. credit limit) is the second-most important factor. Lenders prefer this number to be low. | Pay down your credit card balances. Make multiple payments a month. Request a credit limit increase. |

| Keep Old Accounts Open | The length of your credit history positively impacts your score. Closing an old account shortens your history and reduces available credit. | Use old credit cards for a small, recurring purchase to keep them active. Avoid the temptation to close accounts you’ve paid off. |

| Limit New Credit Applications | Each new application results in a “hard inquiry,” which can cause a small, temporary dip in your score. Too many inquiries can signal financial distress. | Only apply for credit when you genuinely need it. Space out your applications over several months. |

| Check Your Credit Report for Errors | Errors on your report can unfairly lower your score. Reviewing it is a crucial financial health check-up. | Get your free annual credit report from each of the three major bureaus. Dispute any inaccuracies you find immediately. |

How Credit Scores are Calculated Around the World

Credit scoring varies globally; however, the core principle of assessing a person’s creditworthiness remains consistent. Although all systems evaluate a person’s reliability with borrowed money, in fact, the specific scoring models, terminology, and even the type of data used can be quite different. Consequently, understanding these nuances is key.

The information provided here offers a general overview of credit practices in a few countries to highlight these international differences. This is not an exhaustive list, as credit reporting systems and regulations vary widely around the world.

Therefore, if you plan to live or apply for credit in another country, it’s absolutely crucial to research their specific credit system. This is because your credit history from your home country, in general, will not transfer.

United States

| Scoring Models | Key Credit Bureaus | Primary Calculation Factors |

| FICO, VantageScore | Experian, Equifax, TransUnion | – Payment History (35%): The most critical factor; reflects your record of on-time payments. – Amounts Owed (30%): Your credit utilization ratio (debt-to-credit limit) is a key component. – Length of Credit History (15%): The age of your oldest and newest accounts. – New Credit (10%): Recent applications and new accounts opened. – Credit Mix (10%): Having a variety of credit types, such as credit cards and installment loans. |

Canada

| Scoring Models | Key Credit Bureaus | Primary Calculation Factors |

| Equifax, TransUnion | Equifax, TransUnion | – Payment History (~35%): Timely payments are essential. – Credit Utilization (~30%): The ratio of your outstanding balance to your credit limits. – Length of Credit History (~15%): How long your credit accounts have been open. – Public Records & Credit Mix (~10%): A combination of your public records (like bankruptcy) and the variety of your credit accounts. – Credit Inquiries (~10%): Recent applications for credit. |

United Kingdom

| Scoring Models | Key Credit Bureaus | Primary Calculation Factors |

| No single score (lender-specific models) | Experian, Equifax, TransUnion | – Payment History: Records of payments on loans, credit cards, and some utility bills. – Electoral Roll Registration: Being on the electoral register helps confirm your identity and address. – Credit Utilization: The percentage of your available credit that you’re currently using. – Public Records: Information on bankruptcies or County Court Judgments (CCJs). – Financial Links: Your financial relationship with other individuals. |

Australia

| Scoring Models | Key Credit Bureaus | Primary Calculation Factors |

| Comprehensive Credit Reporting (CCR) | Equifax, Experian, Illion | – Repayment History: Detailed records of payments over the past two years, including whether you’ve paid on time. – Credit Utilization: The percentage of your available credit that is currently being used. – Number and Type of Applications: The frequency of your credit applications and the types of loans or credit you have applied for. – Account History: The age and number of your credit accounts. – Defaults and Bankruptcies: Any missed payments (defaults) or legal judgments on your record. |

India

| Scoring Models | Key Credit Bureaus | Primary Calculation Factors |

| CIBIL, Experian, Equifax, CRIF | TransUnion, CIBIL, Experian, Equifax, CRIF | – Payment History (35%): Timely payments on loans (EMIs) and credit card bills are essential. Late payments have the biggest negative impact. – Credit Utilization (~30%): The percentage of your available credit being used. Keeping this ratio below 30% is highly recommended. – Credit Mix: A healthy combination of secured loans (like home or auto loans) and unsecured loans (like credit cards) is viewed positively. – Length of Credit History (~15%): A longer history of managing credit responsibly helps build a strong score. – Number of Recent Inquiries (~15%): A high number of recent credit applications can be seen as a sign of financial distress. |

Patience is Key

Improving your credit score is a marathon, not a sprint. It takes time and consistent, positive financial habits. By focusing on timely payments, keeping your balances low, and managing your credit responsibly, you are building a strong foundation for a more secure financial future.

Reference Links

For reliable, authoritative information on credit scores and credit reports, it’s best to go directly to official government sources and well-established, non-profit organizations.

Official Government Resources

- AnnualCreditReport.com: Only official, government-authorized website where you can get a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once every 12 months.

- Website: https://www.annualcreditreport.com/

- Consumer Financial Protection Bureau (CFPB): The CFPB is a U.S. government agency dedicated to protecting consumers in the financial marketplace. Their website has a wealth of information on credit reports, scores, and how to dispute errors.

- Federal Trade Commission (FTC): The FTC provides consumer advice on a wide range of topics, including credit reports and scores. Also offer guidance on what to do if you are denied credit and how to avoid credit repair scams.

Credit Bureaus

The three main credit bureaus are the companies that collect and maintain the information used to calculate your credit score. They also offer educational resources on their websites.

- Equifax: https://www.equifax.com/personal/credit-report-services/

- Experian: https://www.experian.com/

- TransUnion: https://www.transunion.com/

Non-Profit Credit Counseling Organizations

If you are struggling with debt or need personalized advice, these organizations can provide guidance and resources. Many offer free initial consultations.

- National Foundation for Credit Counseling (NFCC): A network of non-profit credit counseling agencies.

- Website: https://www.nfcc.org/

- Money Management International (MMI): A non-profit organization offering a variety of financial counseling services.

- Website: https://www.moneymanagement.org/

Disclaimer

This information is for general educational purposes only and should not be considered as personalized financial advice. The content is based on common practices and widely accepted principles regarding credit scores in the countries mentioned. However, specific credit scoring models, algorithms, and weighting factors can vary among different credit bureaus and lenders. Your individual credit score is a reflection of your unique financial history, and its calculation may be subject to change over time. It is always recommended to consult with a qualified financial advisor or a reputable credit counseling service for personalized guidance on your specific financial situation. The author and publisher are not liable for any financial decisions made based on the information provided in this article.

Read more blogs at : Okjango.com